Part 1. How did the first lockdown play into the hands of this legislation?

By the time it was announced by HMRC that the implementation date for the legislation would be pushed back by one year, a large proportion of companies had already invested heavily in their approach. In the main, we saw these organisations continue down their chosen path, typically:

- Ban of contractors operating via Personal Service Company’s (PSC) – effectively a blanket banning of outside IR35 contractors!

- Individual contractor or role assessment – the true spirit of the legislation.

The blanket-banning of PSC contractors was largely (but not exclusively) taken by the Financial Services and Professional Services Industries and large multi-national organisations, leaving smaller organisations with an approach more akin to the spirit of the legislation.

In a post-pandemic world, we believe that organisations operating a blanket ban approach will struggle to attract and retain the highly skilled contractors needed to deliver business-critical IT projects in our world of ERP business applications.

But the fact is that during the period January 2020 – July 2020, a vast number of contractors saw their current projects paused and very few new projects starting, meaning that the market flooded with previously unseen numbers of contractors without assignments.

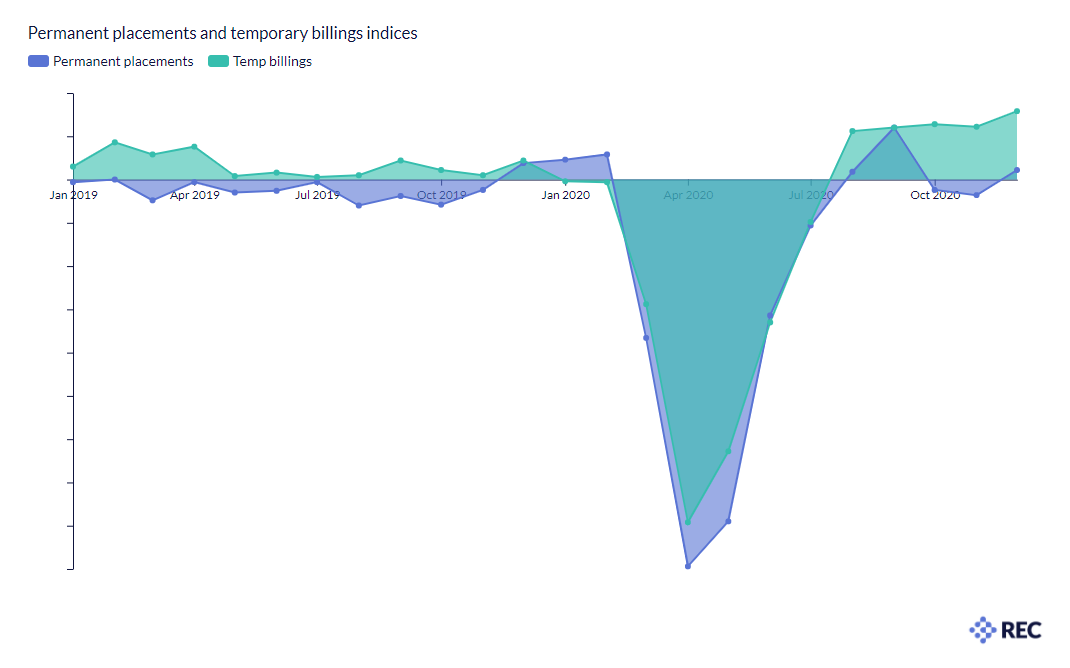

This trend is documented in the IHS Markit permanent placement and temporary billing indices as illustrated below and available on the Recruitment & Employment Confederations website:

The reality of this scenario is that contractors had little or no choice but to accept ‘inside’ IR35 assignments with far lower net remunerations to maintain an income stream. I believe that this is a false trend that we are already starting to see reverse itself!

Since August 2020, there has been a notable increase in new contract opportunities, which is mirrored in the IHS Markit permanent placement and temporary billing indices.

Since August 2020, there has been a notable increase in new contract opportunities.

The result is that we are now seeing an increased reluctance from contractors to accept ‘inside’ IR35 assignments where there has been no ‘due process’ in terms of the “hiring organisation” employing a documented and sensible ‘Status Determination Statement’ process. In the case of a genuinely determined ‘inside’ IR35 status, we are seeing an increase in the rates charged by the contractor (we touch on why later).

This trend will continue to grow as the IT industry comes to terms with the fact that critical IT projects have to continue. The forced change to contractor working practices has shown that IT projects can continue (and continue successfully) with a majority remote workforce over the past three months!

Organisations which are not operating in the spirit of the legislation and blanket banning ‘outside’ IR35 contractors by not operating a Status Determination process, will alienate themselves from highly skilled contractors. Organisations will then not utilise those niche contractors required to deliver their business-critical IT projects successfully.

Therefore, in summary, we believe that over time the market will settle down with genuinely ‘outside’ IR35 assignments becoming more prevalent as the commercial world re-balances back to the normal market forces and demands.

Mark Thomas FIRP

Corporate Sales Director

Ellis Recruitment Group

Read the second part of this series: Has the Government failed in areas of the drafting of this legislation?